Financial Indicators

International Financial Reporting Standards (IFRS) have been applied from the fiscal year ended December 31, 2017.

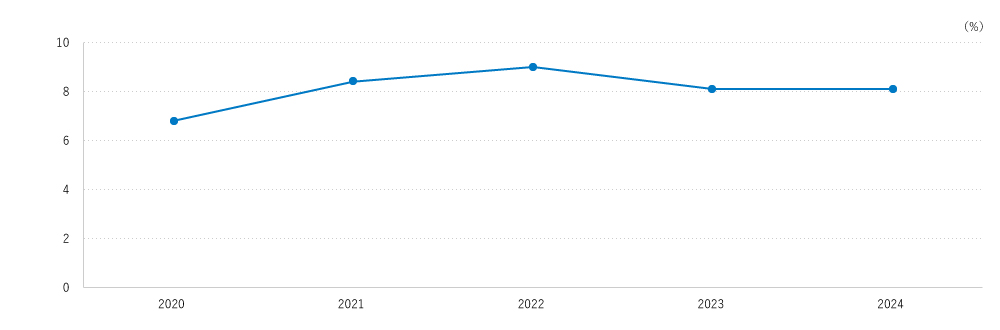

ROE

*Ratio of profit for the year to equity attributable to owners of the Company

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| ROE | 6.8 | 8.4 | 9.0 | 8.1 | 8.1 |

We manage our business with an eye on metrics such as cost of capital, stock price, ROE to drive capital efficiency, and more.

In order to meet the expectations of our shareholders, the Company aims for 2.5 trillion-yen revenue by 2030 through exceeding market growth in our existing businesses and acquiring incremental gains from new growth investments, while also pursuing profit growth that outpaces sales growth. The Company also aims to achieve ROE 9% by 2030 at the latest through the profit growth and growth investment set out in our medium-term management plan.

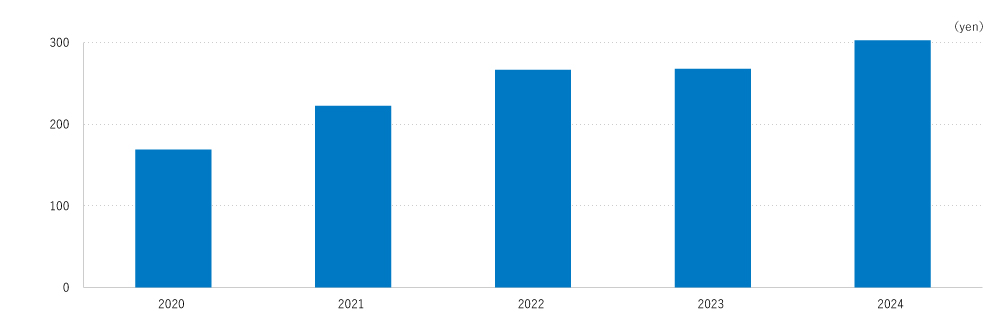

Basic Earnings Per Share

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Basic Earnings Per Share | 168.97 | 222.25 | 266.40 | 267.78 | 302.57 |

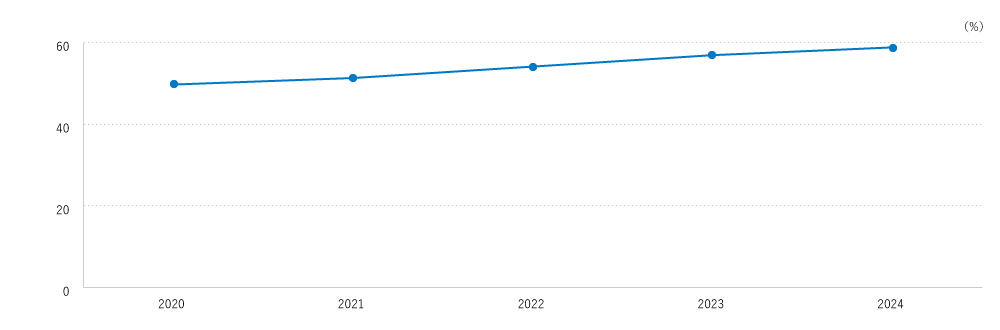

Ratio of Equity Attributable to Owners of the Company to Total Assets

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Ratio of Equity Attributable to Owners of the Company to Total Assets |

49.7 | 51.3 | 54.1 | 56.9 | 58.8 |

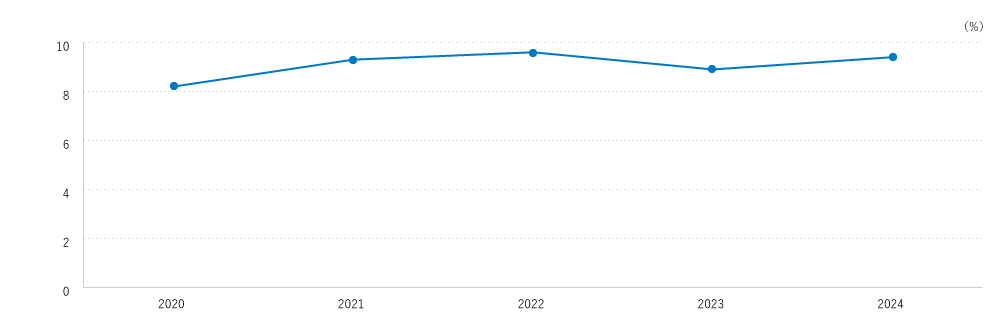

Ratio of Operating Income to Revenue

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Ratio of Operating Income to Revenue |

8.2 | 9.3 | 9.6 | 8.9 | 9.4 |